Rate and Boundary Files

NOTICE Effective January 1, 2023, Kansas will be using an Alternate Boundary file to determine the tax rate and jurisdiction code for sales of food products as provided in Sections 302 and 308 of the SSUTA. Details on the format and use of the Alternate Boundary file are in the Technology Manual, Chapter 5. Contact jody.bartels@sstgb.org if you have questions. Kansas Pub. KS-1223 Food Sales Tax Rate Reduction Please contact Kansas DOR for questions concerning the sales tax on food.

|

The State Contact List has links to the state tax rate information and available tax rate lookups. Use the state's tax rate calculators to look up tax rates for a specific address or zip code in that state.

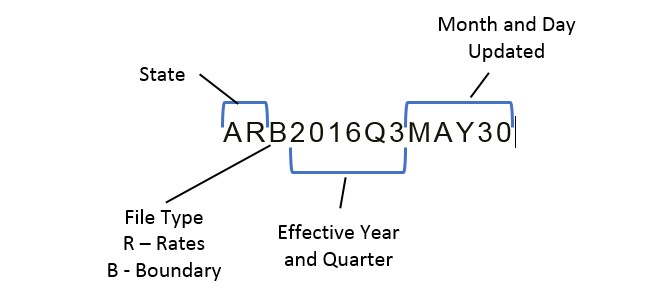

Rate and Boundary Files names indicate which state the file is for and the effective date of the file.

Each Streamlined Member State is required to provide a rate file and a boundary file. The boundary file generally identifies the tax codes (for each taxing jurisdiction) that apply to an address based on either the 5 or 9-digit zip code. However, for some states the tax codes are based on the actual address. The rate file provides the rates that apply to each tax code. Single rate states that have not changed their rate since October 1, 2006, are not required to provide a rate or boundary file.

We recommend you read the Technology Guide chapter 5, Rate and Boundary Files, to help you understand what these files include and how to use the files to determine the correct tax rate. These files are created for use in your tax calculation applications to determine the tax rate. It is difficult to determine a rate by simply looking at the files.

Files are updated quarterly and are to be posted to this website by the first day of the month prior to the beginning of each calendar quarter. States are only required to post a new file if changes were made. Corrected files may be posted at anytime. An email message will be sent to the Rate and Boundary File Update Notices list serv when new files are posted.

Access to Files

File Updates

(List by date of updated files)

State sales tax rates and links to local rates

(included on State Contact List)

Join Our Listserv

Subscribe to the Rate and Boundary File Update Notices Email List to receive an email notice when a state updates their Rate or Boundary files. (Unsubscribe)

Rate and Boundary Files Questions

Email registration@sstgb.org or contact Jody Bartels at jim.romano@sstgb.org or call (405) 779-7702